From the December 2002 Idaho Observer:

101-level stock market primer -- before the crash

by Dave Ray

The stock market brings buyers and sellers together in one place where they enter into a type of auction to purchase shares in a company's stocks, or securities. The New York Stock Exchange (NYSE) is today's market place to purchase shares of the large capitalization companies and is indexed by the Dow Jones Industrial Averages.

It all began some 250 years ago at Manhattan's East River dockyards where early traders met on the piers. The original securities traded were bills of lading which are contracts specific to carriage of goods from the port of shipment to the port of destination. Bills of lading are still in use today. Gold was scarce then, so the traders used Spanish coins called “pieces of eight” because the coins were cut into eight pieces. This is why, until recently, stocks were traded in eighths and sixteenths.

In 1789, mounting war debts from the Revolutionary War forced Congress to issue government bonds. A few years later, bank stocks were issued to help establish the country's first banks. Insurance companies began to appear and an organized pattern of trading emerged.

Wall Street

In 1792, 24 men signed an agreement to sell securities amongst themselves. These 24 men were the beginning of the New York Stock Exchange. By the early 1800s, the members of this group, now numbering in the hundreds, had moved into what is known all over the world as Wall Street. In 1863, they moved again down the street from the original location to the present site of the NYSE.

The Dow Jones Industrial Average lists the high capitalization corporations and is the most commonly quoted index. It is represented by 30 selected industrial stocks that are averaged indicators of general market price trends. The Dow also averages utility and transportation stocks and publishes composite stock and bond averages.

The Nasdaq, AMEX and OTC represent the smaller capitalization enterprises not listed on the Dow.

The AMEX (American Exchange) started in 1921 and the Nasdaq (North American Securities Dealers Automated Quote) began trading February 8, 1971. The over-the-counter (OTC) market evolved when early trading became common place, being sold over-the-counter like any other product.

Since the Dow Jones index is represented by the performance of the 30 most preferred companies from every important sector of the economy, it is considered a weighted index. The S&P 500 (Standard and Poors) is an index of 500 select companies of Dow Jones stocks and, therefore, represents a broader base of the true market value. (The NASDAQ is also on a weighted index basis.)

In the 1950s Merrill Lynch brought trading to the common man by inventing the stock brokerage investment and management business.

Stock values and the P/E ratio

Shares of stock represent a company's “stock in trade” of goods being produced and shipped. The intrinsic value of goods have always had fluctuating intrinsic value in response to marketplace conditions. This is just as true today as it was in the early 1900s. It is this fluctuation and the degree of risk investors attach to the growth potential of a company that offers the opportunity for money to be made, or lost, in the stock market.

Companies have a par value of a few cents to a few dollars per share for their initial public offering, as well as a book value which changes from year to year. For example, if a company has 1 million shares and $20 million in assets after debts, then the book value of its stock is $20 per share.

Such accounting gives a book value but still does not pay dividends. If this same company has, in addition to its book value, made a profit after expenses, to pay $3/share in quarterly installments, for example, then its value for that year is $23 million. Therefore, the theoretical price of this company's stocks would be $23/share. Investors then pay $23/share with an annual dividend of $3/share.

Using the example above we can determine the price-to-earnings (P/E) ratio by dividing $23 by $3 for a P/E of 7.66. The number 7.66 is the amount of time in years it will take for a person to realize a full return of his initial investment.

The P/E ratio is commonly used by investors for determining the value the market has placed on a stock. A P/E ratio of 8 to 12 is generally considered an acceptable time frame for a full return on an investment.

Stocks are initially bought from a company to help the company fund production. When stocks are resold to another investor, the company does not receive proceeds of profit, but the seller does. Hence, stock bought for $23/share during the original offering may eventually be sold for, say, $46/share to another investor. If the company's dividend were to drop to $.50/share, its P/E would then be 92.

A company with a steadily increasing P/E is viewed by the investment community as becoming more and more speculative.

Stock market value

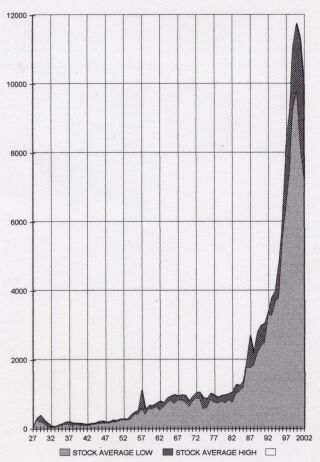

Within the last few years the Dow has been oversold (bid up) by a minimum of about two to three times its true value. If we compare the standard statistics index for common stock prices over the last 90 years we can see what has happened.

In 1914 the market index stood in the 80 range. Just before the 1929 crash of September, 1929 the index reached an average of 216. The bubble that developed at the end of the 1920s climbed as follows: 100 during 1926; 114 by June 1927; 148 by June 1928; 191 by June 1929; 381 its highest by September 3; and then falling to 145 by October 24, 1929 (a 62 percent loss).

The trend in stock prices continued downward for several weeks following the 1929 crash and finally broke into an outright panic. By June, of 1934, the market dropped to 34 -- a loss of 91 percent.

By 1941 the index had only climbed back to the 120 range; by 1950 it was in the 220 range -- still 161 points below its high in 1929. By the end of 1962 the index stood at 652, showing signs of baby boom growth. Yet the market still wouldn't climb above the 1,000 level, other than a brief period in 1973, for another 20 years, averaging in the 850 range until 1983. From there the precipitous climb began and, by 1992, the index broke 3,000. Less than ten years later, 1999, the market hit its all time high of 11,750.

Baby boomers and stock market growth

What we see by the graph is a rate of growth from 1933 to 1985 that is proportional to actual industrial output and population growth. Then the market began its rapid climb. Why did the market do this? If we compare the stock market to an auction where there are more bidders than there are items to bid upon there is a tendency to bid items beyond their worth. That scenario describes the stock-buying frenzy over the last 15 years. This frenzy since the mid-80s is largely the result of the baby boomer generation having excess inherited wealth from the industrial growth of the 50s, 60s and 70s, the growth of the computer age, and their mad rush to get a “piece of the action” while it was hot.

Every pyramid-shaped bubble on the graph eventually corrected itself back to the overall market average. Therefore, we can divide the current index by two to three times and be closer to the true worth. The current pyramid is not complete and would have to drop below the 2,000 range to equal the overall average. However, considering that much of our industrial production is now overseas, the market would be lower yet in actual domestic value.

Contemporary market volatility

Since 9-11, the market has been moving wildly, dropping to a recent low of 7,250 (a 38 percent loss from its high of 11,750) and then, in little over one week's time, it gained 1,300 points and $1.3 trillion. It took almost 200 years to break 1,300 and now 1,300 points can be lost and gained in a little over one week.

Each point on the index represents approximately $1 billion today. The aggregate market loss between the downturn of 1998 and the current downturn is between $6-8 trillion collectively. This does not represent a stable market because today's market does not represent true industrial output. Today's stock market is more akin to a gambling casino. Curiously, Americans continue to gage their nation's economic health by the ups and downs of the stock market.

The NASDAQ reached a high of 5,132 and a recent low 1,172 for a 77 percent loss. The reason the NASDAQ fell so sharply is because it is largely made up of the Dot Com companies whose wealth has mostly been on paper, not backed by hard assets such as machinery and equipment. Everyone bailed out as the companies began folding.

Adding to all this, we now have the recent Enron-style book-cooking of some of the leading companies using pro forma accounting principles instead of generally accepted accounting principles (GAAP). Pro forma accounting methods mislead investors as to the value of a company's stock and compels them to buy shares of their stock at inflated prices. Further, Dow stocks are on a weighted index where stocks are not given an equal percentage, with the 30 top industrials representing market performance. So, for the modern manipulation of the market, one only has to buy into the stocks with the higher weighting on the index to artificially drive the index upward.

The Federal Reserve

Neither presidents, congressmen nor secretaries of the treasury directly have any authority over the Federal Reserve. In matters of money, the Federal Reserve directs them.

The Federal Reserve has stepped into the market on numerous occasions recently and has pumped some $60-90 billion/month into circulation in an attempt to prop up the market. The privately owned Federal Reserve System, which controls our money supply and interest rates, can manipulate the entire economy by creating inflation or deflation, recession or boom, based upon its manipulation of interest rates and the amount of money in circulation. The Fed can send the stock market up or down at its convenience and discretion.

From this we should be able to draw our own conclusions as to the security of securities in this country.

Just in time

Some people claim that a crash will not make much difference because of the larger population, and larger industrial factor (most of which has been sent overseas to capitalize on cheaper child and prison laborers in third world countries). A percentage crash in the market is still a percentage crash, regardless of population.

Also, since most products that we get today are from corporations, the effects of not being more self-sufficient as a nation will most likely be deeper than in 1929. Further indications that Americans are flirting with a supply disaster can be found in the inventory of their merchants. American merchants traditionally inventoried one item to sell and one to show. But merchants today are forced by economic necessity to “show” their wares and have none on inventory. The “just-in-time” nature of modern shopkeeping leaves nothing left in reserve when supply lines are cut and the last items are sold.

The compounded problem

Since the banking industry has been deregulated and allowed to actively participate in the stock market, it has acquired majority control of selected companies. Today's banks, most of which are members of the Federal Reserve banking system, determine the issuance and value of stock shares because they are commonly majority stockholders. This arrangement allows banks to control the nation's economy because they decide what profits will be made, when they will be made and the price shares of stock will sell for. According to Dow Jones, nearly 70 percent of stocks, 75 percent of bonds (including the national debt) and 90 percent of the natural resources are now owned and controlled by a small group of bankers and their stockholders who comprise less than five percent of the population.

Home - Current Edition

Advertising Rate Sheet

About the Idaho Observer

Some recent articles

Some older articles

Why we're here

Subscribe

Our Writers

Corrections and Clarifications

Hari Heath

Vaccination Liberation - vaclib.org